Systematic Investment Plan (SIP) in India – Benefits & Guide

introduction

welcome bullish run blog thanks you for visiting bullish run (today's topic) SIP (Systematic Investment Plan) is an investment method which is a disciplined and convenient way of investing in mutual funds. In this you invest a fixed amount every month or at some fixed interval, which gets automatically deducted from your bank account. what is SIP investment learn it in bullish run

Benefits of SIP:

1. Rupee Cost Averaging:

It helps in protecting from market ups and downs, because you buy units at different prices. Rupee Cost Averaging (RCA) is an investment strategy in which an investor invests a fixed amount at regular intervals, whether the market is up or down. Its advantage is that more units are available when prices are low and fewer units when prices are high. This averages the overall cost and reduces the risk of market volatility. This strategy is very popular for mutual funds, stocks, and SIPs. For long-term investors, RCA provides a disciplined approach that helps build wealth without worrying about market timing.

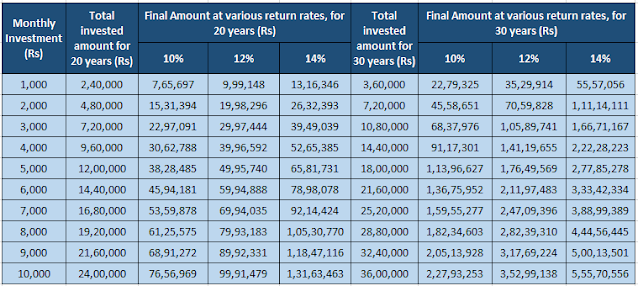

2. Power of Compounding:

Power of Compounding is a financial concept in which the returns you get on your investments are reinvested and returns are generated on them as well. In this way, returns start accumulating on returns, due to which wealth grows at exponential speed. The sooner you start investing and the longer you invest, the more you reap the benefit of compounding. This concept is very effective in investments like mutual funds, stocks, and fixed deposits. Warren Buffett and many other successful investors consider compounding to be the most powerful tool for wealth creation.

3. Disciplined Investing:

Regular investing leads to long-term wealth creation.

4. Start with a small amount:

You can start a SIP with ₹500 or even ₹1000.

5. Tax Benefits:

Tax can be saved through ELSS (Equity Linked Savings Scheme) SIP.

If you want to create long-term wealth, then SIP is a good option. Would you like to know about any specific SIP or mutual fund? Then in this blog, your friend Harsh is going to tell you everything about SIP.

START SIP

To start a SIP (Systematic Investment Plan), you first need to choose a mutual fund scheme. First, decide your investment goal and risk tolerance. Then complete the KYC (Know Your Customer) process, which is done with PAN card, Aadhaar, and bank details. You can register for SIP through a broker, mutual fund website, or demat account. SIP can be started with a minimum of ₹500. There will be an automatic deduction every month after setting the bank mandate. SIP is a disciplined and effective investment method for long-term wealth creation.

CLOSE SIP

To close a SIP, you need to login to your mutual fund provider's website, app, or broker platform. Submit a SIP cancellation request from there. Alternatively, you can also close a SIP by giving a written request to the AMC (Asset Management Company).

Important type of SIP

Every type of SIP is suitable for different investment needs. You should select the best SIP type according to your investment goal.

1. Regular SIP

Regular SIP is a Systematic Investment Plan in which you invest a fixed amount every month, quarter or at any predefined interval. This investment is automatically deducted from your bank account and invested in your chosen mutual fund.

2. Top-up SIP

Top-up SIP is an advanced version of Systematic Investment Plan in which you can increase your SIP amount with time. If your income is increasing, you can also increase your investment. This option helps in long-term wealth creation and beating inflation. It is a flexible and beneficial SIP for investors.

3. Flexible SIP

Flexible SIP is a SIP in which you can increase or decrease the investment amount according to your financial situation. If you have extra funds, you can invest more and can also reduce the amount in a financial crunch. This flexibility is beneficial for investors.

4. Perpetual SIP

Perpetual SIP is a SIP in which there is no fixed tenure. The investment continues as long as you want. In this, you do not specify the maturity date, so it continues for an indefinite period. Whenever you want, you can manually stop it or redeem it.

SIP Calculation Formula:

FV = P \times \frac {(1 + r) ^n - 1} {r} \times (1 + r)

FV = Future Value

P = Monthly Investment Amount

r = Monthly Rate of Return

n = Total Number of Months